Understanding the Impact of the EU's Digital Markets Act on Hotels

In this post, we unravel the EU's Digital Markets Act, its implications for hoteliers, and its influence on direct bookings, shedding light on why industry professionals should understand its potential impact.

As we navigate the digital era, the importance of fair and open online markets cannot be overstated. The European Union is at the forefront of this regulatory push, and their latest initiative, the Digital Markets Act (DMA), aims to foster competition and innovation in the digital marketplace. Unveiled by the EU Commission, this act intends to create a level playing field for all market participants. Today, we'll delve into an overview of this regulation and why it matters to the online ecosystem.

The Digital Markets Act (DMA): An Overview

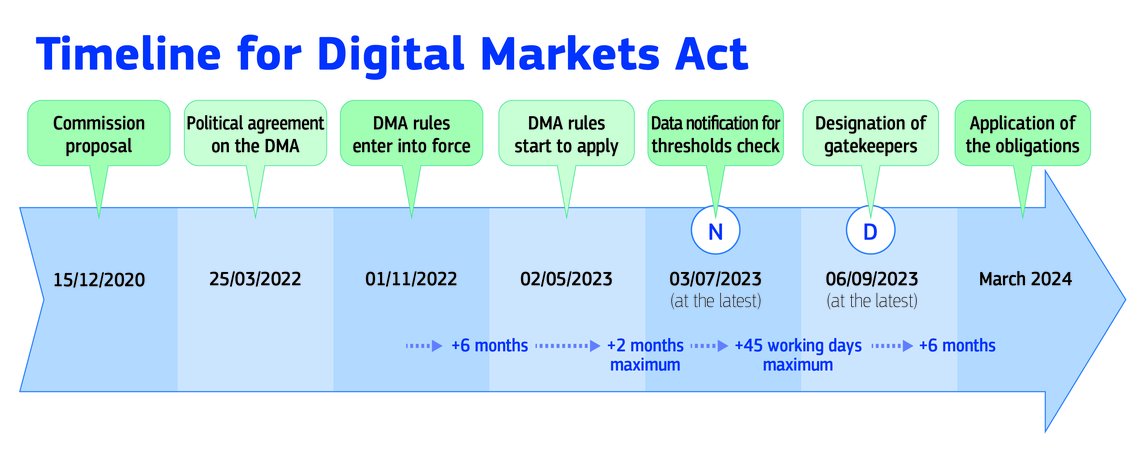

The DMA is a legislative proposal introduced by the EU Commission in December 2020 and rapidly agreed upon by the European Parliament and the Council in March 2022. This act is now coming into force with the objective of rectifying unfair practices by companies acting as gatekeepers in the online platform economy.

In a press release from the EU Commission, the DMA's purpose is stated as, "put an end to unfair practices by companies that act as gatekeepers in the online platform economy". It does so by outlining a series of obligations for these gatekeepers, ranging from behavioural restrictions to transparent business operations.

The EU Commission defines gatekeepers as "digital platforms that provide an important gateway between business users and consumers". Such platforms have a crucial role in the online ecosystem as their position grants them considerable power, sometimes allowing them to function as private rule makers, creating a bottleneck in the digital economy. The DMA’s overarching goal is to curb such unwarranted control.

This act is a significant step towards ensuring a fair digital economy, one that doesn't solely benefit powerful online platforms but also serves the interests of smaller businesses and consumers. It represents the EU's commitment to preserving the integrity of the digital market, thereby fostering a competitive and innovative business environment.

The Criteria for Gatekeepers

To counterbalance the unequal power dynamics in the digital market, the DMA sets precise criteria for identifying "gatekeeper" platforms. These platforms offer one or more "core platform services" such as app stores, online search engines, social networking services, messaging services, video sharing platforms, virtual assistants, web browsers, cloud computing services, operating systems, online marketplaces, and advertising services.

However, simply offering these services does not automatically designate a platform as a gatekeeper. Instead, the DMA outlines three main conditions that determine whether a platform falls under this category:

A size that impacts the internal market: To qualify as a gatekeeper, the company must reach a certain annual turnover in the European Economic Area (EEA) and provide a core platform service in at least three EU Member States.

Control of an important gateway for business users towards final consumers: A platform meets this condition if it provides a core platform service to over 45 million monthly active end users in the EU and more than 10,000 yearly active business users based in the EU.

An entrenched and durable position: This condition is met if the platform has fulfilled the second criterion consistently over the last three years.

In other words, gatekeepers are substantial, influential, and enduring entities in the digital market. This clarification is vital because these platforms wield a significant impact on the digital market's competitiveness and fair play.

The DMA and Online Travel Agencies (OTAs)

Online Travel Agencies (OTAs) may come under the purview of the DMA if they meet the gatekeeper criteria. OTAs are a crucial part of the online travel industry, connecting hotels and accommodations with customers. However, some OTAs may wield considerable market power, which can lead to imbalances in the industry.

With the DMA, these OTAs might be subjected to a series of "do's and don'ts" that ensure fair competition. For instance, they may be prohibited from engaging in practices that favour their own services or prevent business users from reaching consumers, such as hotels trying to reach potential customers.

The potential impact of this is vast. The DMA aims to ensure that gatekeepers do not abuse their market dominance. Those who fail to comply with the obligations under the DMA may face severe consequences. As stated by the EU Commission, penalties could include fines of up to 10% of a company's worldwide turnover, and up to 20% in case of repeated infringements. In cases of systematic infringements, the Commission could even impose behavioural or structural remedies, including a ban on further acquisitions.

Implications for the Hotel Industry

The DMA, with its rigorous regulation of gatekeeper platforms, is set to trigger notable changes in the hotel industry. Particularly, it will influence the relationship between hotels and Online Travel Agencies (OTAs). As the DMA aims to prevent gatekeepers from imposing unfair conditions on businesses, it will level the playing field for hotels that have so far had to navigate the terms set by powerful OTAs.

The EU Commission underlines, "When a gatekeeper engages in practices, such as favouring their own services or preventing business users of their services from reaching consumers, this can prevent competition, leading to less innovation, lower quality and higher prices." Hence, in curtailing these practices, the DMA could allow hotels to compete more effectively in the digital marketplace.

In the context of these changes, the DMA may indeed stimulate a pivotal shift in the hotel industry's approach towards direct booking strategies. In an environment where gatekeepers can no longer engage in potential anti-competitive practices, hotels stand to gain significantly in terms of customer engagement and direct interaction.

A key advantage of direct bookings is the opportunity for a more personalised guest experience. This includes the ability to tailor customer service and offerings based on specific preferences and requirements - an aspect that is often lost in OTA transactions.

This is where platforms like RoomStay become invaluable. RoomStay, a hotel booking engine, is designed to maximise direct bookings for hotels. It enables hotels to take control of their own bookings, pricing, and customer relationships. By utilising RoomStay, hoteliers can mitigate their reliance on OTAs, therefore saving on hefty commission fees and gaining the freedom to directly engage with their customers.

By leveraging the benefits of a platform like RoomStay, hotels can foster stronger customer relationships, increase customer loyalty, and potentially drive higher revenue. The DMA is thus more than a regulatory move; it's an opportunity for hoteliers to rethink their strategies and tools, putting them in a stronger position to capitalise on the benefits of direct bookings.

Timeline for Digital Markets Act - https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6423

Conclusion

The DMA is undeniably a game-changing piece of legislation set to disrupt the dynamics of the digital market, including the hotel industry. By enforcing fair practices and challenging the dominance of gatekeepers, it provides an opportunity for hoteliers to reassess their strategies, particularly in relation to OTAs.

The key takeaway is that the DMA is set to restore balance and encourage a fairer, more competitive marketplace, thus empowering businesses, including hotels, to compete more effectively. Hoteliers are encouraged to stay informed about the DMA and its evolving implications, using this knowledge to adapt their strategies and optimise their competitiveness in the digital market.

Navigating the Future: Next Steps for Hoteliers

In this rapidly changing digital landscape, it is crucial for hoteliers to stay updated with the implications of the DMA for their businesses. We encourage you to keep abreast of these developments, understand their impact on your operations, and explore new opportunities they present.

Moreover, consider this a timely moment to revisit your hotel's booking strategy. With the DMA potentially tempering OTA dominance, you may find it advantageous to shift focus towards direct booking strategies. After all, direct bookings not only help increase profit margins by avoiding commission fees, but also offer the opportunity to establish a direct relationship with your customers, thus enhancing customer loyalty.

Remember, being proactive and adaptable in these dynamic digital times will help secure your hotel's competitive edge and future success.